INSIGHTS

CONSISTENT SURVEILLANCE DEFEATS THE “GOOD DAYS, BAD DAYS” ARGUMENT IN WORKERS’ COMPENSATION

In most cases, people who sustain compensable injuries recover uneventfully and return to their pre-injury lives. Unfortunately for insurers, there are claimants whose recovery is unusually protracted. They report ongoing pain and incapacity that appears disproportionate to the stated cause, the available medical evidence, and - on occasion - surveillance evidence.

The “Good Days and Bad Days” Defence

When faced with evidence showing they can engage in activities seemingly inconsistent with their alleged injury, claimants often respond with a common explanation:

“I have good days and bad days.”

This argument makes it difficult to rely on isolated surveillance footage, as it leaves room for claimants to argue that they were coincidentally observed on one of their “good days.”

Wishart v Brambles Limited

The recent case of Wishart v Brambles Limited addressed this very issue. The decision highlights the importance of conducting surveillance over consecutive days to build a reliable and consistent picture of a claimant’s functional capacity.

In this matter, surveillance demonstrated that the claimant was able to perform activities consistently over multiple days, directly contradicting their claims of significant ongoing incapacity. This evidence proved more persuasive than a one-off observation and undermined the “good days and bad days” defence.

Why This Matters

This case reinforces several important points for insurers:

Consistency matters: surveillance across consecutive days carries more weight than isolated footage.

Context is crucial: evidence must align with medical reports and claimant statements.

Credibility can be tested: when activities contradict claims, surveillance becomes a powerful tool in assessing truthfulness.

Final Thoughts

The Wishart case demonstrates how well-planned surveillance can play a decisive role in resolving disputed workers’ compensation matters. By documenting consistent patterns of activity, insurers can effectively challenge claimants who rely on the “good days and bad days” explanation.

At QNA Investigations, we specialise in discreet, professional surveillance designed to stand up under legal and evidentiary scrutiny.

Read the original article here

Need Clarity in a Complex Matter

At QNA Investigations, we deliver facts, not assumptions - helping a wide range of clients uncover the truth with precision and integrity. If you’d like to know more, contact us by phone on +61 2 9212 5000 or via email at mail@qnainvestigations.com.au.

INSURANCE FRAUD FAIL: FORENSIC EVIDENCE EXPOSES FALSE CLAIM

Insurance fraud doesn’t always involve elaborate schemes or millions of dollars. Sometimes, it’s as simple as staging the theft of a vehicle. But as one Queensland case shows, forensic evidence and financial investigations can expose the truth - and lead to prosecution.

The Claim

In 2013, Rebecca Paulina Riley, 38, alleged that her Mitsubishi Challenger, insured with RACQ for $11,000, had been stolen from outside her home. Shortly afterwards, the vehicle was found burnt out.

Riley told police she no longer had a spare key - an early red flag for investigators.

The Investigation

RACQ referred the case for forensic analysis, appointing a specialist locksmith to examine the fire-damaged vehicle. The results were damning.

At the same time, a review of Riley’s financial circumstances revealed:

Significant personal debts.

A failed loan application shortly before the alleged theft.

Together, these findings suggested motive and opportunity.

The Outcome

Riley was charged and successfully prosecuted for fraud. She received a 12-month prison sentence, wholly suspended for three years.

While the financial amount involved was modest compared to larger fraud cases, the successful prosecution highlights the seriousness with which insurers and courts treat fraudulent claims.

Why This Case Matters

This case demonstrates how specialist forensic investigations can uncover the truth, even when physical evidence has been deliberately destroyed. It also reinforces that:

Financial distress can be a red flag for investigators.

Fraudulent claims of any size carry serious consequences.

Insurers increasingly rely on independent experts to verify claims.

Final Thoughts

Insurance fraud not only harms insurers, it drives up premiums for honest policyholders. Cases like Riley’s highlight the value of thorough investigations and the importance of deterrence.

At QNA Investigations, we support insurers by providing discreet, professional investigation services that uncover the facts and deliver evidence strong enough to stand up in court. If you’d like to know more, contact us by phone on +61 2 9212 5000 or via email at mail@qnainvestigations.com.au.

Read the original article here

ATO LAUNCHES SOPHISTICATED DATA-MATCHING PROGRAM

The Australian Taxation Office (ATO) has announced the launch of a new data-matching program targeting wealthy individuals who may be underreporting their assets and income.

This sophisticated initiative will allow the ATO to cross-reference insurance records and other data sources to paint a clearer picture of taxpayers’ true wealth.

What the Program Targets

The program focuses on high-value assets often associated with wealth, including:

Luxury cars and boats

Private planes

Valuable art collections

Thoroughbred horses

By comparing these assets with reported income and tax records, the ATO aims to identify discrepancies and ensure individuals are meeting their tax obligations.

The Role of Insurers

Insurers are expected to receive formal notices next month requesting details of policyholders with significant insured assets. This cooperation between the ATO and insurance providers will strengthen the program by giving investigators access to data that might otherwise remain hidden.

Who Is in the ATO’s Sights?

The ATO defines “wealthy individuals” as those who, together with their business associates, control net wealth of $5 million or more. These individuals are the primary focus of the data-matching initiative.

Why This Matters

For individuals and businesses, this program is a reminder of the increasing sophistication of financial oversight. Authorities are leveraging data from multiple sectors to uncover hidden wealth, unreported income, and potential tax evasion.

For insurers, the initiative highlights the critical role they play in assisting regulatory agencies - and the importance of accurate recordkeeping.

Final Thoughts

The ATO’s new data-matching program underscores a broader trend: financial and regulatory bodies are becoming more proactive and resourceful in their fight against fraud and tax evasion.

At QNA Investigations, we assist insurers, financial institutions, and law firms by tracing assets, uncovering financial irregularities, and providing evidence that stands up to the highest levels of scrutiny. If you’d like to know more, contact us by phone on +61 2 9212 5000 or via email at mail@qnainvestigations.com.au.

Read the original article here

LIST OF AGENCIES APPLYING FOR METADATA ACCESS WITHOUT A WARRANT RELEASED

The Federal Government has released, under Freedom of Information (FOI) laws, a list of more than 60 federal, state, and local government agencies that have applied to access telecommunications metadata without a warrant.

What Metadata Access Means

Metadata refers to the “data about data” - the details of a communication, such as the time, date, location, and recipient of a phone call, text, or email, but not the actual content.

Under Australia’s data retention laws, telecommunications providers are required to store this information for two years, making it available to agencies investigating crime, national security threats, and regulatory breaches.

Who Applied for Access?

While agencies already classed as “criminal law enforcement agencies” - such as the Australian Federal Police, state police forces, and Australian Border Force - automatically have access, the FOI release revealed that many other bodies have also applied.

These included:

Federal departments outside of traditional law enforcement.

The National Measurement Institute.

Greyhound Racing Victoria.

Bankstown City Council.

The diversity of applicants highlights the broad interest in metadata access, raising questions about necessity, proportionality, and oversight.

Privacy vs. Investigation

Proponents argue that access to metadata is critical for investigating organised crime, cybercrime, fraud, and terrorism. Critics, however, warn that expanding access to non-law-enforcement bodies risks creating a surveillance state and undermines public trust.

As the list shows, interest in metadata is not confined to federal security agencies. Local councils and regulators are also exploring how these powers could apply to their mandates - a development that will likely fuel further debate.

Why It Matters

For businesses and individuals, the key takeaway is this: metadata is no longer private in the way many assume. Investigators - whether police, regulators, or other authorised bodies - increasingly rely on metadata to build timelines, connect individuals, and corroborate evidence.

At the same time, the release raises important questions about who should be entitled to such powers and how to balance investigation with the right to privacy.

Final Thoughts

The release of this list under FOI represents a small but significant step towards transparency in Australia’s surveillance framework. As more agencies push for access, the conversation about privacy, oversight, and proportionality will only intensify.

At QNA Investigations, we operate within strict legal frameworks to gather evidence responsibly and professionally - ensuring that the truth is uncovered without compromising integrity or compliance. If you’d like to know more, contact us by phone on +61 2 9212 5000 or via email at mail@qnainvestigations.com.au.

Read the original article here

Omitting the four redacted names, the full list of agencies can be found here

ORGANISED CRIME COSTS AUSTRALIA $36 BILLION ANNUALLY - FINANCIAL AND INSURANCE SECTORS HIT HARD

A recent report by the Australian Crime Commission has revealed the staggering cost of serious and organised crime to Australia’s economy: $36 billion every year. This figure is more than double earlier estimates and paints a stark picture of the impact of fraud, cybercrime, and related offences.

Fraud Bigger Than the Drug Trade

Organised fraud - including tax evasion, superannuation fraud, card fraud, and financial transaction fraud - accounts for $6.3 billion annually, making it a bigger financial drain than the illicit drug trade ($4.4 billion).

Other key findings from the report include:

$21 billion is spent on fighting crime.

A further $15 billion is allocated to prevention and response efforts.

The financial and insurance sectors spend $2.2 billion annually guarding against organised fraud and cybercrime - their biggest ongoing threats.

Cybercrime costs $1.1 billion annually.

Identity crime costs $1.2 billion annually.

A National Economic Threat

The report is the first time law enforcement has broken down the costs of serious and organised crime. It confirms what many in the private sector already know: organised crime is not only a law enforcement challenge, but also a business risk that directly impacts profitability, reputation, and consumer trust.

For insurers and financial institutions in particular, the costs are immense - and growing. With criminals using increasingly sophisticated methods, detection and prevention are more critical than ever.

Why Investigations Matter

For organisations in the financial and insurance sectors, the challenge lies not only in preventing fraud, but also in responding effectively when it occurs. Key measures include:

Independent investigations to verify facts and uncover hidden evidence.

Fraud risk assessments and policy reviews to strengthen internal systems.

Background checks on employees and third-party partners.

Cyber and identity theft investigations to mitigate digital risks.

The costs of inaction are clear. By failing to detect or prevent fraud, businesses expose themselves to significant financial loss and reputational damage - while fuelling the broader cycle of organised crime.

Final Thoughts

The $36 billion price tag of organised crime is a wake-up call. With fraud, cybercrime, and identity theft among the biggest threats, financial and insurance institutions must continue investing in prevention, response, and independent investigations.

At QNA Investigations, we support organisations with discreet, professional solutions to uncover fraud, minimise risk, and protect against loss. If you’d like to know more, contact us by phone on +61 2 9212 5000 or via email at mail@qnainvestigations.com.au.

Read the original article here

HEAVILY PREGNANT WOMAN STAGES COLLISION TO OBTAIN INSURANCE PAYOUT

On paper, Ghenoua Fadel and her unborn baby were lucky to survive. Police arrived at a rain-soaked Sydney intersection to find two mangled vehicles and a dazed woman, eight months pregnant, complaining of stomach and back pain.

She claimed she had accidentally run a stop sign and collided with another moving vehicle. But hidden eyes were watching: a nearby CCTV camera had captured the entire event - and it told a very different story.

How the “Accident” Was Staged

Like many staged collisions, the incident was carefully orchestrated in a quiet area, late at night, to minimise the chance of witnesses.

The footage showed:

Fadel and alleged accomplice Jamal Gmrawi arriving separately at the intersection.

Gmrawi manoeuvring his Nissan X-Trail into position before stepping out.

Fadel slamming her Toyota RAV4 into the stationary X-Trail.

A third, unidentified person in a separate vehicle keeping watch and later performing a second deliberate hit to exaggerate the damage.

Police and ambulance officers soon arrived on scene, unaware that what looked like a tragic accident was in fact fraud in progress.

Insurance Claims and Forensic Evidence

In the days following, both Fadel and Gmrawi lodged claims with AAMI and NRMA.

But AAMI commissioned a forensic report, which revealed two critical facts:

Gmrawi’s vehicle had been stationary at the moment of impact.

There had been two separate collisions, not one, as would be expected in an accidental crash.

When confronted with this and the CCTV footage, the elaborate deception quickly collapsed.

Court Proceedings

Fadel appeared before Bankstown Local Court, cradling her newborn baby, and pleaded guilty to multiple offences. She admitted that Gmrawi was an associate of her husband and acknowledged her role in the staged collision.

“I was going through a hard time and wasn’t thinking straight,” she told the court. “I was worried about the car I had. I wanted a bigger car for my four children and couldn’t afford it… of course I feel bad, that’s why I pleaded guilty.”

The Bigger Picture: Staged Collisions on the Rise

Far from being isolated, staged collisions are part of a growing national trend. These fraudulent schemes:

Cost insurers millions of dollars annually.

Drive up insurance premiums for honest motorists.

Require sophisticated investigative techniques - from CCTV analysis to forensic crash examination - to expose the truth.

Final Thoughts

This case highlights the crucial role of investigative work in uncovering insurance fraud. Without CCTV footage and forensic analysis, this staged crash might easily have resulted in fraudulent payouts, burdening insurers and everyday motorists alike.

At QNA Investigations, we specialise in uncovering fraud and providing the evidence that stands up under scrutiny. If you’d like to know more, contact us by phone on +61 2 9212 5000 or via email at mail@qnainvestigations.com.au.

Read the original article here

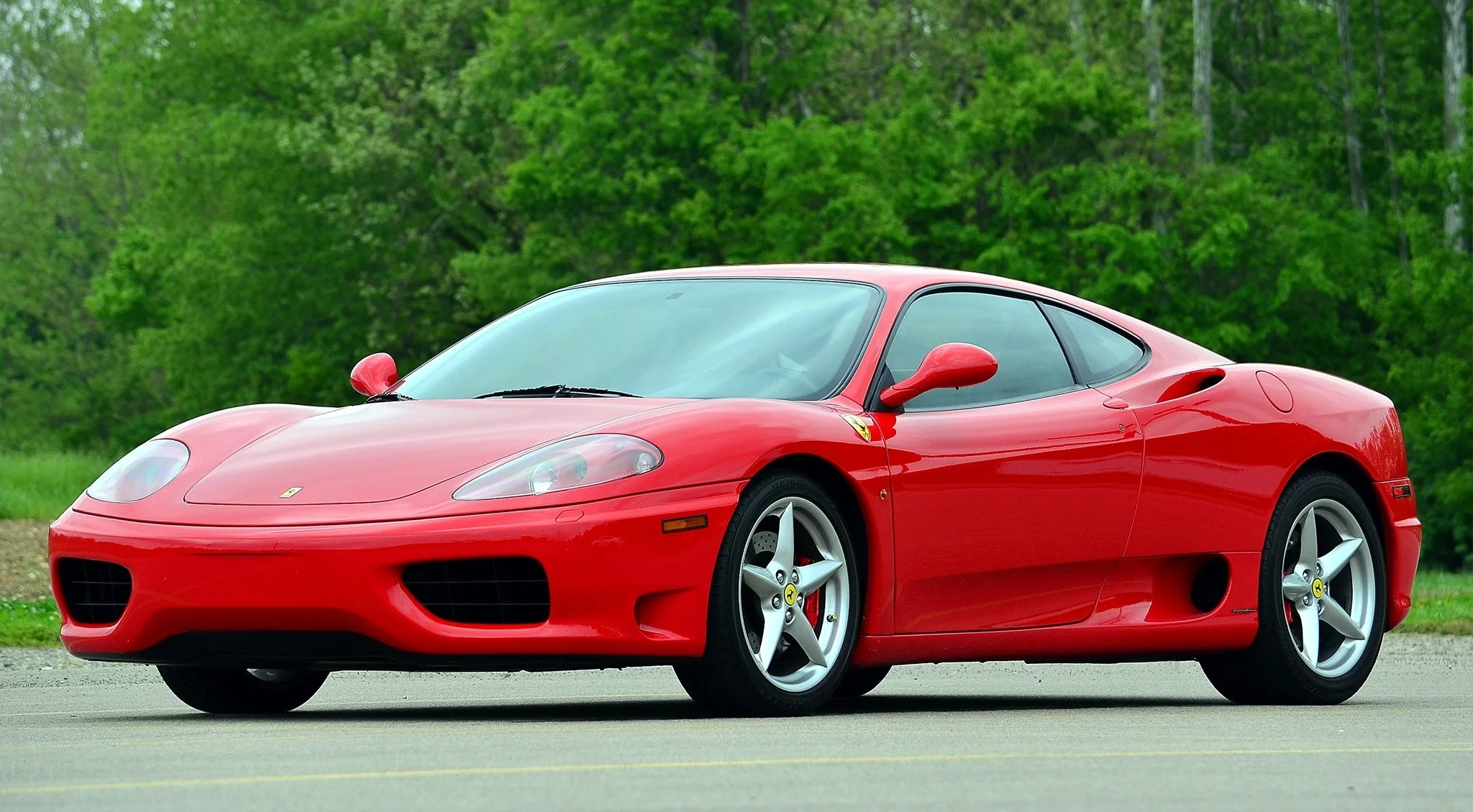

INITIAL ONUS OF PROOF STILL RESTS ON AN INSURED - EVEN IN A FRAUD CASE

The courts have once again confirmed a critical principle in insurance law: the initial onus of proof rests with the insured, even when fraud is alleged.

This principle was at the heart of the case involving Antonio Sgro, who claimed his Ferrari 360 Modena (insured with AAMI for an agreed value of $190,350) was stolen from a suburban Sydney street in 2011.

The Claim and the Dispute

Sgro alleged that his Ferrari was stolen during a five-hour window of opportunity near his home. AAMI investigated the claim and refused payment on the basis that it was fraudulent.

Sgro commenced proceedings in the District Court and later appealed to the Court of Appeal. He was unsuccessful at both stages, with the courts holding that AAMI was entitled to refuse the claim.

Key Legal Principles from the Case

This case highlights several important issues for insurers dealing with alleged fraud:

Onus of proof remains with the insured

Even where a defence of fraud fails, the insured must first establish that their claim is covered under the policy. The onus is not discharged if the likelihood of the insured event having occurred is no greater than the likelihood that it did not occur.Insurers don’t have to disprove the claim outright

An insurer does not bear the onus of disproving the insured’s claim in the first instance.No “benefit of the doubt”

A court should not give a plaintiff the benefit of the doubt if the evidence does not establish that their version of events is more probable than not.Fraud requires more than dishonesty

Dishonesty alone is not enough to make out a defence of fraud under section 56 of the Insurance Contracts Act 1984 (Cth). Clear evidence must show that the conduct was engaged in for the purpose of obtaining a benefit.Establishing fraud is complex

Fraud allegations are hard to prove. Financial motive is only one factor. The insured’s intention to create a false belief to obtain a benefit is a crucial element that must be established.

Why This Matters

For insurers, the case confirms that:

The onus of proof remains with the insured from the outset.

Courts will require clear evidence before accepting fraud as a defence.

Fraud investigations must focus on intention and benefit, not just suspicion or motive.

For insureds, it is a reminder that even without a fraud finding, a claim may fail if it is not proven on the balance of probabilities.

Final Thoughts

This case underscores the importance of thorough investigations and evidence gathering in disputed claims. Fraud allegations are serious and difficult to prove, but insurers are entitled to resist claims where the insured fails to discharge their initial burden of proof.

At QNA Investigations, we assist insurers by uncovering facts, verifying evidence, and providing clarity in complex claims. If you’d like to know more, contact us by phone on +61 2 9212 5000 or via email at mail@qnainvestigations.com.au.

Read the original article here

Read the decision of the court of appeal here

THE CASE: BROTHEL FIRE AND A $770,000 CLAIM

In 2012, a brothel owned by Stealth Enterprises burned to the ground. The business sought a $770,000 payout under its insurance policy with Calliden.

But there was one problem: the company’s sole director, Baris Tukel, was the sergeant-at-arms of the Comancheros motorcycle gang. His brother, Fidel Tukel - well known in boxing circles - managed the brothel.

Calliden refused the claim, arguing that the business had failed to disclose the director’s bikie involvement when applying for and renewing the policy.

The Court’s Decision

Justice Monika Schmidt of the NSW Supreme Court agreed with the insurer. She found that a reasonable person in Stealth Enterprises’ position should have known that links to the Comancheros were relevant to the insurer’s decision to provide cover.

Stealth Enterprises argued that:

Insurers cannot apply a blanket principle that “if you belong to a bikie gang, you can’t get insurance.”

Since Calliden was prepared to insure a brothel, an applicant would not reasonably assume that gang membership was relevant.

Both arguments were rejected. Justice Schmidt was satisfied that, had the bikie connections been disclosed in 2010 (at application) or 2011 (at renewal), the insurer would have refused cover outright.

Why This Ruling Matters

This ruling is landmark in its implications:

It reinforces the importance of full disclosure when applying for insurance - particularly when factors relate to criminal associations or reputational risk.

It demonstrates that insurers are entitled to consider gang membership as material to assessing risk, even where the insured business appears legitimate.

It signals to organised crime figures that insurance fraud and non-disclosure won’t be tolerated by the courts.

Key Takeaway

For businesses, this case is a stark reminder: failure to disclose material facts can invalidate your policy entirely. Even legitimate operations can lose coverage if directors or stakeholders withhold relevant information.

At QNA Investigations, we help insurers uncover critical facts that may otherwise remain hidden - protecting against fraud, non-disclosure, and undue financial loss. If you’d like to know more, contact us by phone on +61 2 9212 5000 or via email at mail@qnainvestigations.com.au.

Read the original article here

Read the decision of the court here

INSURANCE FRAUD - NOT MURDER - PUTS KILLER BEHIND BARS

Sometimes it isn’t the crime of murder that secures justice, but the crime of fraud. In a remarkable case in the United States, Ronald Epps was sentenced to a minimum of 35 years in jail - not for murder itself, but for insurance fraud, arson, and weapons charges.

A Life Insurance Motive

The facts of the case are chilling. Epps shot his girlfriend, Angela Moss, in the back of the head, intending to collect on a $100,000 life insurance policy where he was the beneficiary.

In a separate incident, he set fire to his apartment to claim a payout from his renters’ insurance.

Federal vs. State Prosecutors

The case highlights a stark difference in approach between state and federal prosecutors:

State prosecutors believed the evidence was insufficient to pursue a murder charge, despite the damning circumstances.

Federal prosecutors, however, focused on the insurance element. By proving fraud, arson, and weapons offences, they were able to demonstrate the murder was part of a broader scheme to collect fraudulent payouts.

The jury convicted Epps on those charges - securing a long sentence even though a formal murder charge was never laid.

Echoes of Al Capone

The case is reminiscent of the 1930s prosecution of Al Capone. While law enforcement struggled to convict Capone for violent crimes, they used tax evasion charges to achieve the same end: taking a dangerous criminal off the streets.

In the same way, prosecutors leveraged fraud evidence to hold Epps accountable for a crime that might otherwise have gone unpunished.

Why This Case Matters

This case underscores the power of fraud investigations. Financial motives leave paper trails - and even when direct evidence of violent crime is hard to secure, evidence of fraud can provide the path to justice.

It’s also a reminder that insurers, investigators, and prosecutors play a critical role in exposing fraud schemes that often overlap with other serious crimes.

Read the original article here

At QNA Investigations, we help insurers uncover critical facts that may otherwise remain hidden - protecting against fraud, non-disclosure, and undue financial loss. If you’d like to know more, contact us by phone on +61 2 9212 5000 or via email at mail@qnainvestigations.com.au.

SUSPECT IN TERROR RAIDS ACCUSED OF MILLION-DOLLAR FRAUD

High-profile criminal cases often reveal how closely terrorism, organised crime, and financial fraud can intersect. The recent prosecution of Ahmad Azaddin Rahmany, a 25-year-old Sydney man, is a case in point.

From Terrorism Raids to Fraud Allegations

Rahmany was one of more than a dozen young men targeted in counter-terrorism raids across Sydney. Initially, he was charged only with illegally owning a stun gun and ammunition - items he claimed were leftovers from a hunting trip. He received a two-year good behaviour bond.

Rahmany criticised his inclusion in the raids, arguing that he was targeted because of his Islamic faith and his work as a part-time mechanic.

But investigators continued to monitor his communications. What they uncovered was far from incidental.

A “Complex and Sophisticated” Fraud Scheme

According to police, Rahmany was the “principal architect” of a fraud ring that generated more than $1 million. Together with nine other men, he allegedly:

Fabricated pay slips, tax returns, ATO assessments, and bank statements.

Used deregistered companies and false identities to obtain loans.

Approached businesses with fake company documents to elicit money.

In total, Rahmany now faces 31 fraud charges and one count of possessing a knife following another raid on his family’s Merrylands home. He has been denied bail and will appear in Central Local Court later this week.

Why This Case Matters

This case illustrates how fraud can:

Involve networks of individuals, not just a lone offender.

Exploit weaknesses in financial institutions through falsified documents.

Be linked to individuals already under investigation for unrelated serious offences.

For businesses, lenders, and insurers, it’s a reminder of how important it is to verify documents, check company records, and recognise red flags that may signal fraud.

The Bigger Picture

Fraud of this scale has wide-reaching impacts - from direct financial loss to reputational damage and strained resources for banks, insurers, and government bodies.

At QNA Investigations, we specialise in identifying fraudulent behaviour, verifying information, and uncovering the truth. With tailored investigative solutions, we help businesses, law firms, and financial institutions minimise risk and respond effectively when fraud is suspected. If you’d like to know more, contact us by phone on +61 2 9212 5000 or via email at mail@qnainvestigations.com.au.

Read the original article here

At QNA Investigations, we help clients uncover critical facts that may otherwise remain hidden - protecting against fraud and undue financial loss. If you’d like to know more, contact us by phone on +61 2 9212 5000 or via email at mail@qnainvestigations.com.au.

7 SIGNS SOMEONE MAY BE LYING TO YOU

Spotting deception

Spotting deception is not always easy. While many people think liars avoid eye contact, the opposite can also be true - some deliberately overcompensate, maintaining intense eye contact in an attempt to control the situation or manipulate your perception.

Fortunately, there are subtle behavioural clues that can indicate dishonesty. Here are seven simple signs that someone may be lying to you:

A Rigid Stance → Liars sometimes stand unnaturally still, adopting a stiff, catatonic posture that looks out of place in normal conversation.

Staring or Sudden Head Movements → They may stare without blinking much, or suddenly change their head position when questioned directly.

Protective Gestures → Touching the mouth, covering vulnerable body parts, or shuffling their feet are instinctive behaviours when someone feels exposed.

Changes in Breathing and Voice → Deception can cause heavier breathing, raised shoulders, or a shallow voice as the body reacts to stress.

Repetition and Over-Explaining → Liars may repeat words or provide excessive, unnecessary detail - often to buy time while gathering their thoughts.

Difficulty Speaking → Dry mouth and decreased salivary flow can make it harder to speak clearly, leading to hesitations or awkward pauses.

Defensiveness and Hostility → Becoming hostile, overly defensive, or pointing fingers at others can be a way to deflect attention.

Understanding Stress vs. Deception

It’s important to remember that these behaviours don’t always mean someone is lying. Many of the same signs appear when people are nervous, stressed, or anxious. What matters is the context, consistency, and combination of signals, rather than a single action in isolation.

When people lie, the body reacts physiologically - increased heart rate, changes in blood flow, and reduced saliva production all contribute to the outward signs we see. Liars also often overcompensate with talking, hoping that an appearance of openness will make them seem more believable.

Final Thoughts

Detecting deception is as much an art as a science. By paying close attention to body language, tone, and behaviour, you can often identify when someone’s story doesn’t add up.

At QNA Investigations, we deliver facts, not assumptions - helping a wide range of clients uncover the truth with precision and integrity. If you’d like to know more, contact us by phone on +61 2 9212 5000 or via email at mail@qnainvestigations.com.au.

PACT TO CLAIM LIFE INSURANCE LANDS TEACHER & SECURITY GUARD IN JAIL

When Insurance Fraud Turns Criminal: The Case of Esther Maree Vella and Peter Siskos

Insurance is designed to provide security and peace of mind - but when people attempt to exploit the system, the consequences can be severe. Few cases illustrate this more dramatically than the failed $1.7 million insurance fraud involving Sydney schoolteacher Esther Maree Vella and her partner, Peter Siskos.

A Desperate Plan

Vella, burdened with a $700,000 debt on her Strathfield property, devised a chilling scheme. She persuaded her long-suffering partner, Siskos, to take out a $1.7 million life insurance policy naming her as sole beneficiary. The plan relied on Siskos deliberately ending his life, enabling Vella to claim the payout and clear her debt.

But when the moment came, Siskos could not follow through. Instead of throwing himself in front of a train at Croydon, the 49-year-old security guard vanished from work and slept rough for over a week before being spotted in Burwood Park.

The Investigation Unfolds

The conspiracy began to unravel when several people came forward, saying Vella had let slip details of the macabre plan. One of her tenants, Tony Appleby, admitted to helping destroy incriminating evidence and later cooperated with police.

Wearing a listening device, Appleby recorded a damning conversation with Vella. They discussed suicide by train, attempts to cover their tracks, and her “lost opportunity” to claim the payout.

Court Proceedings

Vella and Siskos were charged with conspiracy to defraud OnePath Insurance. The prosecution argued that they deliberately omitted Siskos’ suicidal intentions when applying for the policy - a clear breach of their duty of disclosure.

Both denied the allegations, but the evidence proved overwhelming. A District Court jury convicted the pair beyond reasonable doubt.

Vella was sentenced to 6½ years’ jail (non-parole: 4 years 9 months).

Siskos received 2½ years’ jail (non-parole: 15 months).

Both appealed their convictions and sentences, but the Court of Criminal Appeal dismissed the appeals, describing the case as “extremely unusual.”

Why This Case Matters

This case underscores the serious consequences of insurance fraud. What began as a desperate attempt to erase debt spiralled into criminal conspiracy, imprisonment, and ruined lives. It’s a stark reminder that insurers, investigators, and courts take fraudulent claims seriously — and that transparency in insurance applications is not optional, but a legal obligation.

Read the original article here

Read the Court of Criminal Appeal judgment here

Need Clarity in a Complex Matter

At QNA Investigations, we deliver facts, not assumptions - helping a wide range of clients uncover the truth with precision and integrity. If you’d like to know more, contact us by phone on +61 2 9212 5000 or via email at mail@qnainvestigations.com.au.

THE IMPACT OF FRAUD ON AUSTRALIAN BUSINESS

Fraud is one of the most significant yet underestimated risks facing Australian businesses today. While not all employees engage in misconduct, studies show that 55% of all fraud committed against Australian businesses comes from within the organisation itself.

Fraud is often difficult to detect and its impact can be devastating - not only financially, but also to reputation, employee morale, and client trust.

The Alarming Statistics

Numerous case studies highlight just how costly fraud can be:

The average fraud case amounts to $3 million.

60% of fraud cases take more than three years to detect.

61% of fraud cases result in no recovery at all.

Fewer than 5% of businesses have insurance to protect against fraud.

Overall, fraud costs Australian businesses an estimated $8.5 billion annually.

These figures demonstrate that fraud is not just an operational risk - it is a strategic threat.

Reducing the Risk of Fraud

While no business is immune, there are practical steps that can reduce exposure:

Conduct rigorous background checks on all prospective employees.

Implement and regularly review internal policies and procedures to ensure they remain relevant and effective.

Encourage anonymous reporting mechanisms, such as whistleblower hotlines, to detect misconduct earlier.

Stay informed about developing fraud trends, both locally and globally.

Why Action Matters

Fraud allegations should always be reported to police as soon as they are identified. However, businesses cannot assume that law enforcement will take immediate action to safeguard their interests. With limited resources, police are unable to investigate every report comprehensively.

This is where professional investigators add value - providing businesses with the clarity, evidence, and support needed to make informed decisions and protect their interests.

How QNA Can Help

If you believe your business has been the victim of theft or fraud, QNA Investigations can help. Our specialist investigators deliver discreet, professional solutions to uncover the facts, gather admissible evidence, and support businesses in resolving fraud matters effectively. If you’d like to know more, contact us by phone on +61 2 9212 5000 or via email at mail@qnainvestigations.com.au.