INSIGHTS

WHEN FRAUD HITS MULTI-MILLIONS, YOU NEED A TEAM - AND INVESTIGATORS AT THE CENTRE

INTRODUCTION

Large-scale fraud isn’t a simple accounting error or a misposted invoice. It’s a complex web of transactions, shell companies, and hidden relationships - often spanning countries, systems, and currencies. By the time anyone notices, millions have already moved through invisible channels.

Fact: Multi-million-dollar fraud schemes often involve multiple jurisdictions, complex corporate structures, and sophisticated digital manipulation. Detecting them requires more than spreadsheets - it requires professionals.

THE COMPLEXITY OF MULTI-MILLION-DOLLAR FRAUD

Fraud at this scale thrives on multiple layers of complexity:

Hidden Entities - shell companies obscure the true perpetrators.

Human Deception - insider collusion, forged documents, and false identities make it hard to know who to trust.

Multiple Jurisdictions - funds move across borders, complicating detection and recovery.

Digital Sophistication - encrypted communications and hidden databases conceal activity.

Without a team approach, these schemes often remain invisible - until it’s too late.

COLLABORATION: THE KEY TO SUCCESS

No single expert can tackle multi-million-dollar fraud alone. Each discipline contributes a critical piece of the puzzle:

Investigators - uncover hidden networks, locate key individuals, conduct interviews, obtain leverage and connect dots no one else can see.

Technologists - track digital footprints and uncover patterns invisible to the naked eye.

Forensic Accountants - follow the money, uncover irregular transfers, and expose hidden revenue streams.

Behavioural Analysts - reveal the psychology behind deception and identify behavioural red flags.

Legal & Compliance Experts - ensure investigations are actionable, highlight governance breaches, and advise on recovery.

Pro Tip: The real breakthroughs happen when these disciplines intersect - human intelligence meets financial data, digital evidence, and behavioural insights.

INVESTIGATORS: THE LINCHPIN

Investigators are often the glue that holds complex fraud cases together. They turn fragmented leads, emails, financial records, and witness statements - into a structured, actionable investigation.

CASE EXAMPLE

In a multi-country fraud, we identified key players, coordinated interviews that ultimately led to confessions, and worked with accountants, technologists, and legal experts to map and recover some of the misappropriated funds.

Without investigators at the centre, the pieces of the puzzle never align.

WHO MAKES THE BIGGEST IMPACT?

So, when it comes to uncovering complex, multi-million-dollar fraud, who really makes the biggest difference?

Specialist investigators

Technologists tracking digital trails

Forensic accountants following the money

Legal and compliance teams keeping everything above board

Answer: It’s almost always all of them. Each discipline adds a unique perspective, and their collaboration turns complexity into clarity.

WHY QNA INVESTIGATIONS STANDS OUT

At QNA, we know that multi-million-dollar fraud requires more than expertise - it demands teamwork, precision, and strategy.

OUR APPROACH

Coordinated Teams - investigators collaborate with accountants, technologists, behavioural analysts, and legal experts.

Actionable Insights - complex fraud becomes evidence that can be acted upon immediately.

Global Reach - multi-jurisdiction cases - we have the experience and networks to trace fraud across borders.

Bottom Line: When millions are at stake, every lead counts. Every detail matters. And every piece of the puzzle needs to come together. That’s why a multidisciplinary team isn’t just an advantage - it’s essential.

NEED CLARITY IN A COMPLEX MATTER

At QNA Investigations, we deliver facts, not assumptions - helping a wide range of clients uncover the truth with precision and integrity. If you’d like to know more, contact us by phone on +61 2 9212 5000 or via email at mail@qnainvestigations.com.au.

INVESTIGATION REPORTS VS INTELLIGENCE BRIEFS: WHAT EVERY ORGANISATION NEEDS TO KNOW

INTRODUCTION

In today’s fast-paced corporate and legal landscape, the ability to turn information into actionable insight can make or break decisions. At QNA Investigations, we often see organisations confused between investigation reports and intelligence briefs - two tools that serve very different purposes. Understanding the difference is critical for legal, corporate, and strategic decision-making.

INVESTIGATION REPORTS: DOCUMENT WHAT HAPPENED

Investigation reports are designed to capture the facts. They tell you what happened, backed by evidence, and can guide legal or operational action.

These reports are ideal when an organisation needs clarity, accountability, or a documented trail to support future decisions.

COMMON USES

Litigation Support: collecting evidence for civil or criminal proceedings, preparing briefs for courts, lawyers, or regulators.

Asset Tracing and Recovery: locating hidden or misappropriated assets, tracing funds, or supporting recovery efforts.

Internal Disciplinary Matters: investigating employee misconduct, harassment, conflicts of interest, or breaches of company policy.

Fraud and Financial Misconduct: identifying fraud, accounting irregularities, embezzlement, or misappropriation of funds.

Corporate Governance and Compliance: detecting regulatory breaches, bribery, or corruption.

Regulatory or Law Enforcement Referral: preparing reports that may go to police, prosecutors, or regulators.

Governance & Strategic Decision-Making: informing boards about exposures, corrective actions, and reputational or financial impact.

Risk Management and Operational Reviews: reviewing operational failures, security incidents, or third-party misconduct.

Key takeaway: Investigation reports focus on evidence and facts. They tell you what happened and often trigger immediate action.

INTELLIGENCE BRIEFS: GUIDE WHAT TO DO NEXT

If investigation reports look backward, intelligence briefs look forward. They analyse information to help organisations anticipate risks, make strategic decisions, and plan proactively.

Intelligence briefs are typically shared with a limited audience, helping executives, boards, and legal teams make informed choices.

COMMON USES

Strategic Risk Assessment: evaluating reputational, financial, or operational risks and providing early warnings.

Market or Sector Intelligence: monitoring competitors, industry trends, and potential operational exposures.

Behavioural or Pattern Analysis: identifying unusual activity, suspect behaviour, or trends that could impact operations.

Threat and Vulnerability Analysis: tracking fraud schemes, cyber threats, or vulnerabilities in governance and operations.

Litigation and Investigative Planning: guiding legal teams and investigators to focus on high-risk areas.

Counterparty & Third-Party Evaluation: conducting due diligence on clients, partners, or suppliers to identify risks or conflicts of interest.

Supporting Law Enforcement or Regulators: providing intelligence that shapes future investigative priorities.

Key takeaway: Intelligence briefs help you anticipate and decide, turning information into foresight rather than just hindsight.

INVESTIGATION REPORT VS INTELLIGENCE BRIEF: THE BOTTOM LINE

At QNA Investigations, we simplify it like this:

Investigation report = understand and act - evidence-based, fact-driven, and often triggers immediate action.

Intelligence brief = anticipate and decide - analytical, forward-looking, and supports strategic decisions.

By using the right tool for the right purpose, organisations can not only respond effectively to issues but also stay one step ahead of potential risks.

TURNING INFORMATION INTO ACTIONABLE INSIGHT

Whether you’re navigating a complex corporate investigation, managing operational risk, or planning a strategic move, understanding the difference between investigation reports and intelligence briefs is crucial. At QNA, we help organisations make sense of information so they can act decisively and confidently.

NEED CLARITY IN A COMPLEX MATTER

At QNA Investigations, we deliver facts, not assumptions - helping a wide range of clients uncover the truth with precision and integrity. If you’d like to know more, contact us by phone on +61 2 9212 5000 or via email at mail@qnainvestigations.com.au.

STRENGTHENING FAMILY LAW MATTERS FROM DAY ONE: THE CASE FOR EARLY INVESTIGATIVE INVOLVEMENT

At QNA Investigations, we see every day how the earliest stages of a family law matter can determine everything that follows - from the quality of advice and negotiations to the final outcome in mediation or court.

When a new matter lands on a lawyer’s desk, the foundation for success rests on one thing: the quality of information gathered at the very beginning.

Most people’s first instinct is to contact a lawyer, which makes perfect sense. But that first call should also be for quality evidence.

While family lawyers guide the legal strategy, investigators lead the evidence path - capturing facts, testing assumptions, and identifying gaps that can make or break a case. When both work together from day one, every matter starts on its strongest footing.

WHY EARLY INVESTIGATIVE INVOLVEMENT MATTERS

Clients often provide instructions during times of stress or heightened emotion. Understandably, this can lead to missing or distorted details that may affect case preparation later on.

By bringing an investigator in early, lawyers can ensure that the evidence base is complete, accurate, and court-ready.

At QNA Investigations, early involvement allows us to:

Conduct comprehensive client interviews to capture relevant facts and prevent gaps.

Review and analyse supporting documentation for accuracy and completeness.

Trace witnesses, financial records, and digital trails to uncover the full picture.

Protect client digital accounts and devices from unauthorised access.

Secure and preserve evidence so it remains admissible and verifiable.

Identify leverage points that can strengthen a client’s position during negotiation or mediation.

By handling these critical early tasks, we free lawyers to focus on what they do best - legal strategy, client advice, and case management - with confidence that the factual groundwork is sound.

STRATEGIC AND MEASURABLE BENEFITS

An evidence-first approach delivers clear advantages for both clients and firms:

Stronger, more defensible case preparation.

Reduced risk of surprises in mediation or litigation.

Protection of client privacy, reputation, and parental rights.

Early insight into potential risks, inconsistencies, or weaknesses.

Greater time and cost efficiencies - early preparation saves weeks later.

This approach isn’t just proactive - it’s transformative.

REAL-WORLD RESULTS

In one commercial matter heading to mediation, a client claimed his business partner had misappropriated $1.8 million. By testing the client’s account and analysing digital evidence, we uncovered that the partner had fabricated invoices totalling $1.6 million - while the client’s son had secretly diverted another $200,000. Metadata also revealed document tampering.

With that evidence in hand early, the law firm entered mediation with a verified, defensible position - achieving a $1.6 million resolution without litigation. It completely changed the trajectory of the case.

APPLYING THE SAME PRINCIPLES TO FAMILY LAW

Family law matters are among the most complex and emotionally charged areas of legal practice. Allegations can be deeply personal, and objectivity can easily be clouded by emotion.

Early investigative involvement helps separate fact from assumption - ensuring that every claim, document, and digital trace is properly verified.

In a recent family law case, we worked with a firm handling a property settlement and parenting dispute. Our early involvement led to:

Disproof of false allegations about the wife’s personal conduct.

Evidence of the husband’s unreliability in his childcare responsibilities.

Proof that the husband’s financial disclosure was incomplete and falsified.

Securing of the wife’s digital accounts after detecting unauthorised access by the husband.

The result was a stronger parenting outcome and a fairer property settlement - all underpinned by independent, court-ready evidence. The cost of investigation was far outweighed by the result achieved.

WHY THIS APPROACH WORKS

When lawyers and investigators collaborate from the start, they achieve:

Stronger, more defensible cases.

Greater efficiency and reduced costs.

Protection of client privacy and reputation.

Early strategic insight that informs smarter legal decision-making.

Confidence that all facts, claims, and documents have been tested.

Just as importantly, early collaboration helps avoid the risks that come from waiting too long - missing evidence, incomplete facts, or late-stage surprises that can weaken a case once proceedings are underway.

BUILDING A STRONGER FOUNDATION TOGETHER

At QNA Investigations, our role is to build the proof path - ensuring every piece of evidence is tested, preserved, and ready to support your legal strategy from day one.

By partnering early with family lawyers, we help establish a structured, evidence-first process that:

Streamlines your workflow.

Reduces overall case costs.

Strengthens client outcomes.

Enhances confidence in the facts before you advise or act.

Put simply: you shape the legal path - we build the proof path. Together, we give clients the best possible chance of achieving a fair, evidence-based resolution.

NEED CLARITY IN A COMPLEX MATTER

At QNA Investigations, we deliver facts, not assumptions - helping clients uncover the truth with precision, professionalism, and integrity. If you’d like to know more about how early investigative involvement can strengthen your next matter, contact us by phone on +61 2 9212 5000 or via email at mail@qnainvestigations.com.au.

CHAOS IN THE WAREHOUSE: A COMPLEX WORKPLACE INVESTIGATION

INTRODUCTION

QNA Investigations was engaged to examine a workplace incident that left a lasting impact on an employee, a family, and a business. What initially seemed like separate injury claims quickly unfolded into a complex, multi-layered investigation, requiring meticulous fact-finding, collaboration with authorities, and sensitive handling of traumatised witnesses.

A ROUTINE DAY TURNED CATASTROPHIC

The incident took place at a warehousing company’s premises in Western Sydney. On that day, a routine workday escalated into violence. One employee was critically injured after being accidentally shot while the shooter aimed for the company’s managing director, a known member of an OMCG, who was fatally shot in what police later confirmed was a gang-related dispute. The shooter, a member of a rival OMCG, was later identified, tracked down, and charged by police.

Colleagues were caught in the chaos, witnesses traumatised, and emergency services arrived within minutes. The immediate aftermath raised urgent questions for insurance, workplace safety, and legal considerations.

MULTIPLE CLAIMS, COMPLEX QUESTIONS

In the weeks following the incident, three insurance claims were lodged:

The injured employee submitted a workers’ compensation claim for the severe physical injury sustained during the shooting.

A claim was submitted regarding the managing director’s death, raising questions about whether his fatality was covered under workers’ compensation.

The wife of the deceased submitted a claim for psychological injury, alleging trauma from witnessing her husband’s death.

While these claims initially appeared straightforward, our investigation revealed they were far more complex. Each claim required careful examination of timelines, witness accounts, and supporting evidence to determine eligibility and veracity.

INVESTIGATING WITH CARE AND PRECISION

We approached the matter methodically and sensitively.

We conducted structured interviews with the injured employee, other witnesses, and the family of the deceased. Each interview was audio-recorded and transcribed to ensure accuracy.

We liaised closely with first responders, law enforcement, accountants, and regulatory bodies, gathering CCTV footage, phone records, company documents, and medical reports. A key focus of the investigation was the managing director’s death: verifying timelines, confirming witness presence, and exploring connections to external criminal activity.

The injured employee’s detailed account provided a crucial perspective. He described the minutes leading up to the shooting, the chaos as it unfolded, and the urgent medical care he received. Importantly, his testimony also confirmed that he was not the intended target - an essential detail for insurance and legal considerations.

FINDINGS AND OUTCOMES

Impact on individuals: The incident had far-reaching consequences. The injured employee faced significant physical injury requiring ongoing medical treatment and rehabilitation, while the family of the deceased managing director endured profound personal, emotional, and financial disruption.

Investigation and insurance outcomes: Our investigation clarified the circumstances surrounding all claims:

The injured employee’s workers’ compensation claim was accepted, reflecting the verifiable nature of his injuries sustained during the workplace incident.

The managing director’s fatality was determined to be linked to criminal activity outside the course of his employment, resolving questions that arose during the investigation and confirming it was not compensable under workers’ compensation.

The wife’s psychological injury claim was declined. Evidence confirmed she was not an employee, was not present at the premises during the incident, and her claims of witnessing the events were contradicted by emails, phone records, toll records, and warehouse CCTV footage.

LESSONS CONFIRMED

Every detail matters: From CCTV to emails, phone records, and corporate documents, accurate evidence is essential.

Comprehensive interviews: Speaking with all witnesses, even under emotional or fragmented accounts, helps uncover the truth.

Sensitivity and professionalism: Trauma-affected individuals must be treated with empathy, patience, and respect.

Collaboration with authorities: Coordinating with police, medical professionals, and legal representatives ensures investigations remain credible and actionable.

CONCLUSION

In a matter of minutes, lives were irrevocably changed. The investigation demonstrated the importance of methodical, ethical, and empathetic inquiry, particularly when multiple claims and complex circumstances intersect.

By raising and resolving critical questions around the managing director’s death - including the accidental nature of the employee’s injury - we provided clarity for the insurer, employees, and the family. This case reinforces our commitment to guiding clients through the most sensitive and challenging cases with professionalism, precision, and respect.

NEED CLARITY IN A COMPLEX MATTER

At QNA Investigations, we deliver facts, not assumptions - helping a wide range of clients uncover the truth with precision and integrity. If you’d like to know more, contact us by phone on +61 2 9212 5000 or via email at mail@qnainvestigations.com.au.

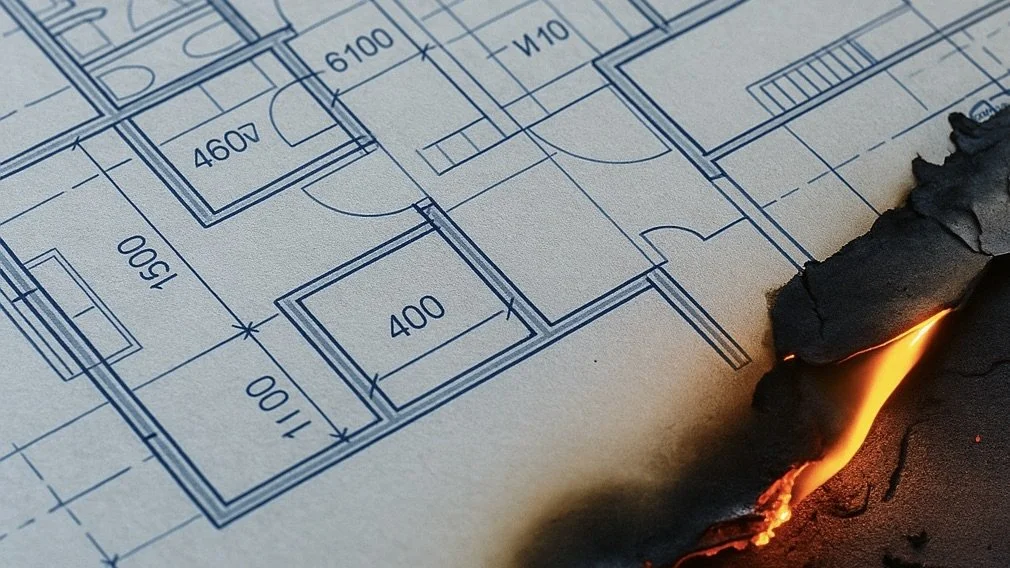

DAVID VS GOLIATH: HOW INVESTIGATIONS EXPOSED FRAUD, FEAR, AND FIRE IN PROPERTY DEVELOPMENT

INTRODUCTION

Over six-months, a small but ambitious property developer paid more than $400,000 in unusual payment requests to his business partners. Some of these demands had no connection to the project and raised serious concerns.

For a time, he complied. But when the financial strain became too great, he began asking questions. That was when everything changed.

FIRE, FEAR, AND INTIMIDATION

Soon after he resisted further demands, a suspicious fire tore through the development. Days later, his family home was targeted in a drive-by shooting.

Because of the joint venture structure, he carried the greatest financial and legal risk. The timing of these incidents sent a chilling message: failure to pay came at a very different cost.

Desperate for answers, guidance, and safety, he turned to QNA Investigations.

OUR INITIAL FINDINGS

Our initial review of the joint venture documentation revealed the true nature of the arrangement:

a large, well-connected company, with links to organised crime; and

a small, inexperienced developer, eager to establish himself in large-scale projects.

In his eagerness, our client had entered the partnership without proper advice or due diligence. What seemed like an opportunity was, in reality, a deal stacked against him.

With our support, and after engaging specialist lawyers, he came to understand that the financial structure of the venture was far less advantageous than he believed.

FRAUD IN THE RECORDS

Our analysis of financial records revealed a pattern of manipulation:

supplier quotes were altered before being passed on;

supplier invoices were doctored to significantly inflate costs; and

payments were demanded under pressure, unrelated to the project.

These quotation and invoicing irregularities were later confirmed by suppliers. Almost all acknowledged discrepancies - from quotes tampered with and resent from compromised email accounts, to invoices rewritten without their knowledge.

DIGGING DEEPER

Our enquiries extended beyond the project itself. By tracing former associates of the larger company, we uncovered evidence of similar incidents of fraud, extortion, and duress payments in three earlier developments.

This showed our client’s experience was not an isolated event, but part of a broader pattern.

SUPPORTING OUR CLIENT ON ALL FRONTS

The financial impact was immense. We worked with our client’s bank, reconciling the $400,000+ in payments against falsified invoices. Although the funds could not be recovered, this created a clear evidentiary trail for police and lawyers. Just as importantly, it also reassured the bank that our client was the victim of fraud and extortion, protecting both his reputation as a borrower and his future borrowing capacity.

At our client’s request, we also worked with his insurer, providing clarity around both the fire and the shooting. This supported the insurer’s investigation and confirmed our client bore no responsibility for either incident.

We helped our client secure specialist legal representation and collaborated closely with his legal team, supplying evidence packs, timelines, and corroborated witness statements. With their assistance, our client was able to explore all legal avenues open to him.

To ease the unexpected financial burden, we also connected our client with a trusted private lender, ensuring he had access to funds to cover costs arising from the extortion and the fire.

BUILDING THE CASE

Most critically, we interviewed over 80 individuals connected to our client’s development, the two incidents, and previous projects involving the larger developer. These interviews were audio-recorded, transcribed, and formally attached to our brief of evidence for police and included in our detailed report for the client’s lawyers.

In contrast, the larger company refused to cooperate - a stance that only reinforced the obstructive pattern we had documented.

Given the threats, the complexity of the scheme, and the volume of enquiries, our investigation spanned 12 months. It was structured, meticulous, and designed to withstand scrutiny in both legal and criminal forums.

Three weeks after our investigation concluded, police arrested and charged the two men behind the extortion. Both were directors of the larger company - confirming their responsibility and reinforcing the evidence we had gathered.

THE HUMAN COST

For our client, this was not only a financial ordeal. Each coerced payment, each threat, and each act of violence carried a personal toll. The fire and shooting left his family living in fear, unsure of what might happen next.

This was more than a commercial dispute. It was financial manipulation coupled with intimidation, leaving one party to shoulder all the risk.

LESSONS FOR THE INDUSTRY

This case highlights critical lessons for property developers:

Seek advice early - proper guidance before entering major ventures is essential.

Do your homework - independent due diligence on partners can prevent devastating mistakes.

Beware power imbalances - smaller parties in joint ventures often carry disproportionate risk.

Follow the money - even if funds cannot be recovered, financial trails provide vital evidence.

Document everything - recorded interviews and structured investigations give credibility in legal and criminal forums.

History repeats - patterns of misconduct can often be identified through proper due diligence.

Collaboration works - coordinating investigators, lawyers, insurers, banks, and police strengthens outcomes.

CLOSING THOUGHTS

Our client entered a joint venture with the dream of delivering a major residential project. Instead, he faced fraud, intimidation, arson, and threats - all because he carried the most risk and dared to question payments.

With QNA by his side - through a 12-month, structured, and meticulous investigation - he learned a valuable lesson, strengthened his legal position, and found the courage to fight back.

We specialise in supporting clients through the most complex and hostile circumstances - and in helping businesses avoid falling into these traps in the first place.

Because in business, as in life, questions need answers.

NEED CLARITY IN A COMPLEX MATTER

At QNA Investigations, we deliver facts, not assumptions - helping a wide range of clients uncover the truth with precision and integrity. If you’d like to know more, contact us by phone on +61 2 9212 5000 or via email at mail@qnainvestigations.com.au.

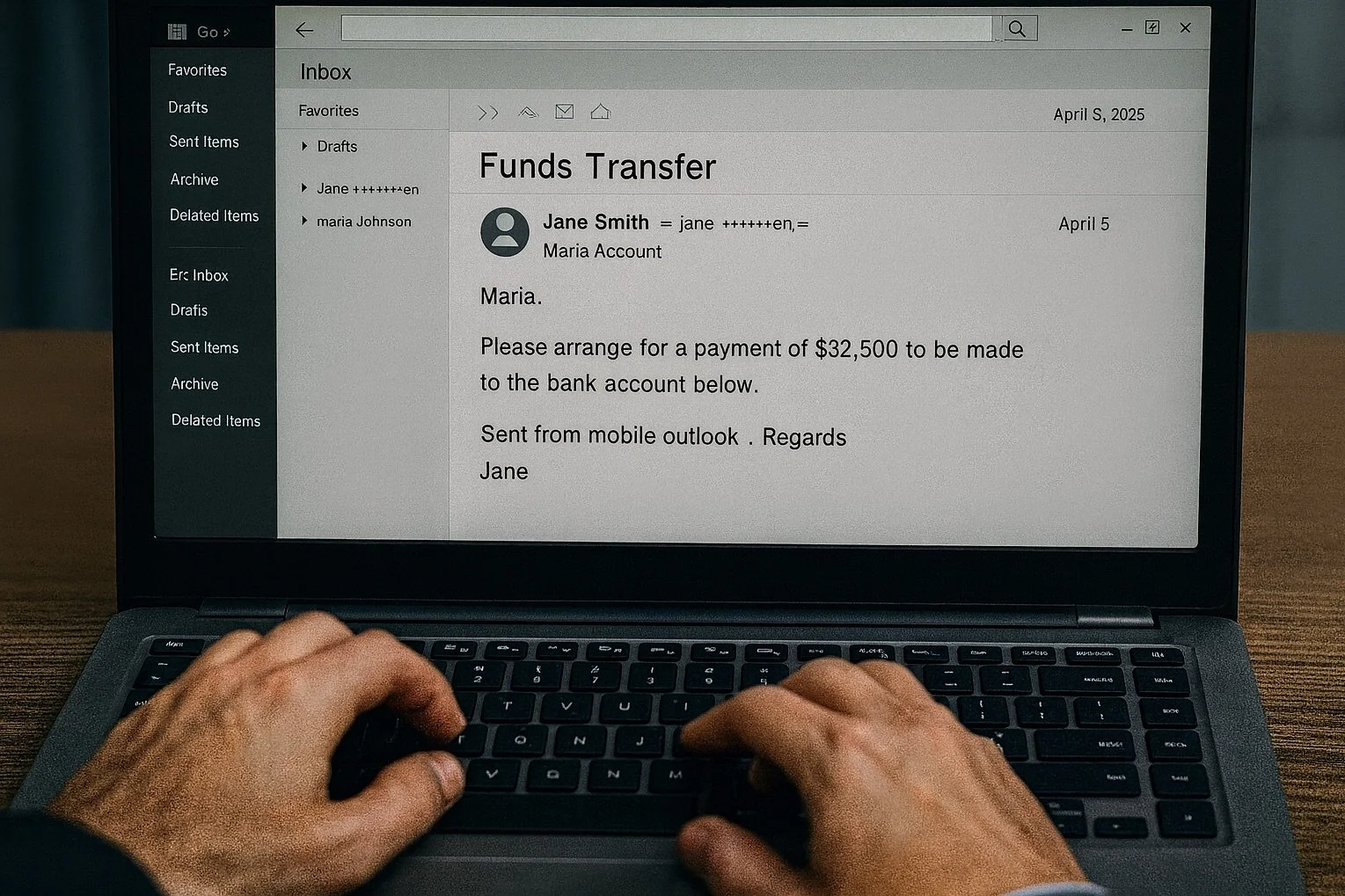

WHEN SIMPLE EMAILS COSTS A LAW FIRM $70,000: LESSONS FROM A CYBER FRAUD INVESTIGATION

INTRODUCTION

It wasn’t ransomware. It wasn’t a phishing link. It wasn’t malware. Just two plain-text emails. Within 48 hours, a respected boutique Sydney law firm was $70,000 poorer.

We were engaged on behalf of a leading insurer to unravel what happened. What we uncovered reveals just how easily trust can be weaponised against professionals who pride themselves on diligence and integrity.

INSIDE THE FRAUD

The firm’s principal was travelling overseas. Back at the office, her practice manager received two emails that seemed routine: instructions to transfer funds.

The tone was familiar. The language was confident. The emails even appeared to come from the principal’s account.

But there was a subtle difference. Instead of her usual personalised signature, the messages carried a generic sign-off: “Sent from mobile outlook.. Regards [Name]”.

Believing the instructions were genuine, the practice manager processed the transfers: $32,500 on day one, $37,500 on day two.

By the time the error was discovered, the funds had been routed through a Commonwealth Bank account, stripped out in rapid withdrawals at ATMs in Queensland and Malaysia, and scattered across borders.

When we traced the account holders, the story took an even darker turn. The accounts were in the names of two elderly men - one in his seventies, another in his nineties - both unwell and living in aged care. Their stolen identities had been hijacked by organised fraudsters as camouflage.

HOW THEY GOT IN

Our review revealed the firm’s principal had not enabled two-factor authentication (2FA) on her email account.

Forensic analysis showed the account had been accessed repeatedly by unknown devices in India for several months before the fraud. This gave the offenders ample time to:

monitor her movements;

study her communication style; and

know exactly when she was travelling.

Armed with that intelligence, the fraudsters struck at the perfect moment. To further conceal their tracks, the spoofed messages were routed through a VPN, masking their true origin and complicating any digital tracing.

FOLLOWING THE DIGITAL FOOTPRINTS

Working on behalf of the insurer, we pieced together a troubling chain of deception:

Timing was strategic - the fraudsters struck while the principal was abroad.

Email compromise was central - no 2FA meant her account was exposed for months.

Spoofed emails deceived staff - the practice manager believed she was acting on genuine instructions.

Foreign logins went unnoticed - repeated access from devices in India was ignored.

Technology was tactical - spoofing and VPN masking hid the perpetrators’ location.

Identity theft was layered in - elderly victims were unknowingly tied to fraudulent accounts.

Money moved fast - tens of thousands gone within hours, across two countries.

Insurance failed - despite cover being in place, the insurer ultimately denied the claim, leaving the firm to absorb the loss.

WHY EVERY FIRM SHOULD TAKE NOTE

This case shows how seemingly small oversights can open the door to devastating losses:

Fraudsters exploit absence and authority - they monitor accounts and strike when principals are unavailable.

Weak email security invites compromise - without 2FA, inboxes are open windows into a firm’s operations.

Spoofed emails can fool trusted staff - even experienced managers can be misled when messages appear genuine.

Foreign logins are red flags - regular reviews of account activity can catch intrusions early.

Insurance is not guaranteed - policies don’t always respond and claims can be denied.

QNA’S PERSPECTIVE

As investigators, our role goes beyond reconstructing what happened. We spotlight the blind spots that allowed it to happen.

In this matter, we showed how:

a lack of 2FA,

ignored logins,

spoofed emails, and

delayed incident response

all combined to create the conditions for a $70,000 loss.

Fraudsters are becoming increasingly sophisticated, blending identity theft, cyber compromise, and international laundering tactics. But with vigilance, stronger controls, and expert investigative support, law firms can stay ahead.

NEED CLARITY IN A COMPLEX MATTER

At QNA Investigations, we deliver facts, not assumptions - helping a wide range of clients uncover the truth with precision and integrity. If you’d like to know more, contact us by phone on +61 2 9212 5000 or via email at mail@qnainvestigations.com.au.

WHEN A BUSINESS DISPUTE BECOMES FRAUD: UNCOVERING THE TRUTH BEHIND A $315,000 CLAIM

INTRODUCTION

At QNA Investigations, we are often called upon when complex disputes blur the line between civil disagreement and criminal deception. One recent matter demonstrates just how vital a thorough, independent investigation can be when large sums of money - and reputations - are on the line.

THE BACKGROUND

Two men - both successful property developers in their own right - met in a pub and decided to go into business together. Without any formal agreements governing their partnership, they began working jointly on a number of large projects across New South Wales.

As is often the case in such informal arrangements, they shared heavy plant equipment - excavators, rollers, and machinery worth hundreds of thousands of dollars - to reduce their individual capital expenditure and operating costs. This made their large-scale projects more financially feasible and competitive.

When the relationship soured, the lack of formal agreements proved costly. The two men ended up in court over their partnership, each accusing the other of misconduct. During the litigation, Developer A accused Developer B of stealing the shared equipment from two construction sites. He reported the alleged theft to NSW Police and then lodged an insurance claim. Police did not investigate, and the insurer accepted the claim without question - paying out $315,000 to Developer A.

LAWYERS BROUGHT IN

After the payout, the insurer’s lawyers reviewed the claim and quickly realised there were unanswered questions. They attempted to speak with both developers, but neither would engage with them. Recognising that the matter required deeper investigation, they engaged QNA Investigations.

OUR INVESTIGATION

Our role was clear: establish what had actually happened to the equipment and test the credibility of the competing allegations.

We began by contacting and formally interviewing all relevant parties. Each interview was meticulously structured, audio recorded, and transcribed.

During this process, Developer B - unhappy at being labelled a thief - provided us with CCTV footage. The footage was time-stamped and dated three weeks before the insurance claim was lodged. It clearly showed Developer A, the claimant, collecting and removing the supposedly “stolen” equipment himself.

When confronted with this footage during his formal interview, Developer A insisted it was falsified or generated using artificial intelligence. We subsequently conducted independent verification and confirmed the footage was genuine. Several key individuals corroborated its authenticity.

A second interview was conducted with Developer A, giving him the opportunity to address the inconsistencies in his evidence. Once again, he insisted the CCTV footage was falsified or AI-generated. When asked to permit an inspection of a warehouse he had recently acquired through another company, he abruptly terminated the interview and left our office. All further attempts to contact him were ignored.

THE OUTCOME

Our comprehensive report - which included interview transcripts, audio recordings, and verified CCTV footage - was provided to the insurer’s lawyers. This gave them a clear evidentiary basis to advise their client on recovering the $315,000 that had been wrongfully claimed.

Without our investigation, the fraud would have gone undetected - leaving the insurer significantly out of pocket and rewarding deceptive behaviour.

THE VALUE OF INDEPENDENT INVESTIGATION

This case underscores why insurers, law firms, and businesses turn to us when matters are too complex to be resolved by paperwork alone. By applying rigorous investigative methods, corroborating evidence, and independent analysis, we are able to uncover the truth - even when one party is determined to conceal it.

At QNA, questions lead to answers. And in this matter, those answers exposed the truth and stopped a fraud that would otherwise have gone unchecked.

NEED CLARITY IN A COMPLEX MATTER

At QNA Investigations, we deliver facts, not assumptions - helping a wide range of clients uncover the truth with precision and integrity. If you’d like to know more, contact us by phone on +61 2 9212 5000 or via email at mail@qnainvestigations.com.au.

THE FIRST STEP THAT CAN MAKE OR BREAK YOUR CASE: WHY INVESTIGATORS BELONG IN THE ROOM FROM DAY ONE

INTRODUCTION

The foundation of any strong legal matter lies in the quality of information gathered at the outset. Whether a case involves general disputes, preparation for mediation, or more complex litigation, the way instructions are taken can have a direct impact on the eventual outcome. For law firms, this early stage presents a crucial opportunity to strengthen case strategy - and bringing in an investigator can make all the difference.

A DIFFERENT PERSPECTIVE FROM THE START

Lawyers are skilled at identifying the legal issues. Investigators, however, approach matters from a fact-finding perspective. Their role is to test assumptions, uncover gaps, and highlight inconsistencies that may otherwise go unnoticed. This doesn’t replace the lawyer’s work - it complements it, ensuring that from the very beginning, the client’s story is assessed through both legal and investigative lenses.

This broader perspective is valuable in a variety of contexts:

Dispute resolution: Early fact-checking can de-escalate conflicts and prevent issues from escalating further.

Mediation preparation: Investigative insights can clarify the facts, expose weaknesses, and provide leverage in negotiations.

Litigation, family law, and commercial matters: A strong factual foundation reduces risks, saves costs, and strengthens the case as it progresses.

IDENTIFYING GAPS AND LEADS

When instructions are first taken, clients often provide information shaped by memory, stress, or their own perspective of events. Investigators are trained to:

Spot inconsistencies in timelines, documents, or accounts.

Recognise missing information that could later prove critical.

Identify potential leads, such as third parties to interview, digital records to secure, or financial trails to examine.

By addressing these issues early, law firms reduce the risk of surprises during mediation, court proceedings, or settlement negotiations.

CASE STUDY: EARLY INVOLVEMENT IN MEDIATION

A leading Sydney law firm recently engaged QNA Investigations at the instruction-taking stage of a commercial dispute heading to mediation. The client, distressed and uncertain, had discovered $1.8 million missing from his company and accused his business partner of taking the money.

During those initial instructions, our involvement proved critical. By carefully listening, clarifying, and asking targeted questions, we were able to identify gaps and inconsistencies in the client’s account - gaps that, if left unchecked, could have shaped the matter in the wrong direction.

Just as importantly, we identified weaknesses in the client’s own management practices. Poor internal controls and limited oversight had created opportunities for his business partner and, separately, his son to access company funds with ease. These vulnerabilities explained not only how the misappropriation occurred, but also why it continued for so long without being detected.

Once the concerns were clarified, we moved quickly to test them against the evidence. Our investigation revealed that over an 11-month period, the business partner had created fraudulent PDF invoices using the names of legitimate clients. Each invoice had been altered - the dates were changed, the reasons for payment fabricated, and the partner’s personal bank account details inserted. These invoices, totalling $1.6 million, were then submitted to the company’s accounts department and paid directly to him.

In addition, our enquiries revealed that the client’s son, who was aware of the dispute but not initially under suspicion, had misappropriated a further $200,000 for himself.

We reviewed all available financial records, compared them against legitimate client activity, examined internal company emails, and conducted a forensic analysis of the metadata contained in the subject invoices. Metadata - the hidden data embedded in digital files - confirmed the invoices had been tampered with after they were created.

Armed with this clear evidence, the law firm entered mediation with a strong, verifiable case. What had initially been positioned by the opposing party as a “business misunderstanding” was exposed as deliberate and sustained fraud. The result was a favourable $1.6M resolution for the client, achieved without the cost and delay of protracted litigation.

This case highlights how early investigative involvement - even at the instruction-taking stage - can change the trajectory of legal advice. By clarifying facts, exposing management weaknesses, and uncovering fraud from the very beginning, investigators ensure that lawyers proceed with stronger strategy, sharper focus, and the evidence they need to secure the best outcome.

STRENGTHENING CASE STRATEGY

Early collaboration between lawyers and investigators provides:

Efficiency: Clear objectives mean enquiries are targeted and cost-effective.

Clarity: Evidence is gathered in a way that directly supports the legal strategy.

Confidence: Lawyers and clients can proceed knowing potential weaknesses have been tested and addressed from the outset.

This is as important in mediation, where factual accuracy can shape negotiations, as it is in litigation, where evidence must withstand scrutiny.

A SMARTER WAY FORWARD

We’ve seen first-hand how early involvement benefits law firms and their clients - whether in dispute resolution, mediation, or more formal legal proceedings. By being present during the instruction-taking stage, we help ensure no detail is missed, no lead is overlooked, and no opportunity for stronger evidence is lost.

For law firms, the message is clear: bringing investigators in early is not just useful - it’s strategic. It sets matters on the right track from day one, giving clients the best chance of a successful resolution - in mediation, settlement, or the courtroom.

NEED CLARITY IN A COMPLEX MATTER

At QNA Investigations, we deliver facts, not assumptions - helping a wide range of clients uncover the truth with precision and integrity. If you’d like to know more, contact us by phone on +61 2 9212 5000 or via email at mail@qnainvestigations.com.au.

PRIVACY, PROPORTIONALITY, AND FACE PRINTS: LESSONS FROM THE KMART OAIC RULING

INTRODUCTION

The recent OAIC ruling that found Kmart in breach of the Privacy Act over its use of facial recognition technology (FRT) is a landmark decision. It underlines how boundaries between security, fraud prevention, and individual privacy are increasingly scrutinised - and rightfully so.

At QNA Investigations, we believe this case offers crucial lessons for businesses, legal practitioners, and anyone working in investigations that touch on personal data and biometric identifiers.

WHAT WENT WRONG: KEY MISSTEPS BY KMART

No meaningful consent from customers: Consent isn’t a checkbox. It must be clear, informed, and specific. Kmart failed to get customers’ consent before collecting biometric data (face prints). Without that, the collection can’t satisfy the Privacy Act’s legal requirements.

Disproportionate use of technology: Even if refund fraud is a valid concern, using biometric FRT on every customer entering stores (or being captured in public-facing areas) is quite invasive. OAIC emphasised there were less intrusive alternatives.

Lack of privacy impact risk balancing: The ruling hinges on whether the privacy intrusion is justified by the benefit. OAIC determined Kmart could not reasonably believe the benefit outweighed the privacy cost in this case.

WHY THIS RULING MATTERS FOR BUSINESSES & INVESTIGATORS

Litigation risk: Misuse of biometric data or using face recognition without consent can lead to OAIC investigations, reputational damage, and legal scrutiny.

Regulatory clarity: The decision clarifies that companies deploying biometric tech must align with privacy laws - consent, purpose limitation, proportionality, data protection.

Forensic relevance: In any investigation where biometric or facial recognition tech is involved, preserving metadata, understanding the systems, and checking for compliance are critical.

HOW ORGANISATIONS SHOULD RESPOND

Audit existing biometric/face recognition systems: Check whether they have documented consent, proportionate usage, privacy impact assessments, and if there are less invasive alternatives.

Review policies, vendor contracts, and data retention: How is the data stored? Who has access? How long is it kept? Are there transparency and deletion policies?

When planning investigations, include privacy and data experts early: Whether you’re investigating workplace misconduct, refund fraud, or anything involving biometrics, engaging legal and investigative specialists from the start ensures compliance and reduces risk.

Train staff & customers: Ensure staff handling or managing biometric tech understand the legal, ethical, and privacy dimensions. Inform customers appropriately about any biometric collection.

IMPLICATIONS FOR QNA INVESTIGATIONS’ WORK

Our work often touches on technologies, data sources, and systems - all of which may raise privacy issues. From this ruling, we reinforce our internal best practices:

Ensuring any investigative technology used is compliant with privacy law.

Maintaining chain of custody and secure handling of biometric or sensitive personal data.

Using metadata and technical evidence to verify claims about how biometric systems are operated.

Advising our clients (law firms, corporations) on the legal risk of deploying or relying on biometrics.

CONCLUSION

The OAIC’s decision against Kmart isn’t just a win for privacy advocates - it’s a wake-up call for all organisations and legal teams handling sensitive personal data. Security and fraud prevention are legitimate objectives - but not at the cost of privacy rights. Business strategies, investigative methods, and technologies must align with legal standards of consent, proportionality, and fairness.

We stand ready to help businesses and legal professionals navigate these complex terrain - ensuring that investigations protect both evidence and privacy.

NEED CLARITY IN A COMPLEX MATTER

At QNA Investigations, we deliver facts, not assumptions - helping a wide range of clients uncover the truth with precision and integrity. If you’d like to know more, contact us by phone on +61 2 9212 5000 or via email at mail@qnainvestigations.com.au.

UNCOVERING THE TRUTH: SUPPORTING A FAMILY LAW FIRM IN COMPLEX PROCEEDINGS

HOW THOROUGH INVESTIGATIONS HELPED SECURE A FAVOURABLE OUTCOME IN BOTH FINANCIAL AND PARENTAL MATTERS

Family law disputes are rarely straightforward. Emotions run high, allegations are often contested, and the stakes are deeply personal - affecting both financial security and the wellbeing of children. In such cases, the difference between a compromised result and a fair one often comes down to independent evidence.

Recently, QNA Investigations was engaged by a prominent family law firm to assist in protracted proceedings involving both a disputed property settlement and contested parenting arrangements.

THE DISPUTE

The matter involved two central areas of conflict:

FINANCIAL SETTLEMENT

Alleged asset concealment: The wife argued that her husband had failed to disclose his true financial position, alleging that he diverted income through company structures and undervalued his business interests.

Lifestyle vs disclosure: Although claiming limited means, the husband maintained an expensive lifestyle - luxury vehicles, international travel, and business investments - suggesting hidden resources.

Documentation issues: Bank statements and tax returns provided by the husband did not align with the couple’s historic standard of living, raising concerns that assets had been concealed.

Falsified records: The husband submitted documents to support his financial disclosure, but closer inspection suggested they had been altered.

PARENTING ARRANGEMENTS

Allegations of alcohol abuse: The husband claimed that his wife was an alcoholic and therefore unfit to care for their young children.

Allegations of online activity: The husband further alleged that the wife operated an OnlyFans account, arguing this made her an unsuitable role model.

Concerns about care: The wife, in turn, alleged that the husband was unreliable, citing repeated failures to collect the children from school and other commitments.

Household stability: Both parties sought to prove that they could provide the more stable and nurturing environment for the children.

OUR INVESTIGATIVE ROLE

We were tasked with testing these allegations and uncovering the facts. Our enquiries included:

Financial analysis: Tracing the husband’s corporate and financial interests, linking him to undisclosed entities and property holdings.

Metadata examination: Forensic review of financial documents confirmed that records had been manipulated after creation, undermining the husband’s credibility.

Surveillance on the husband: Discreet monitoring revealed behaviour inconsistent with his claims - including leisure activities during times he alleged to be working and repeated failures to meet childcare responsibilities.

Allegation verification: Extensive checks confirmed there was no evidence that the wife operated, or had ever operated, an OnlyFans account.

Alcohol allegation checks: Independent enquiries confirmed that the wife did not abuse alcohol, disproving the husband’s claims.

Cybersecurity support: During proceedings, the wife suspected that her husband was accessing her personal accounts. Our forensic enquiries confirmed this. We then assisted her in securing her digital footprint by changing passwords, enabling two-factor authentication, and strengthening protections across her email, banking, social media, and other accounts.

Independent verification: Third-party checks validated asset ownership and further undermined the husband’s disclosure.

Importantly, QNA was engaged early in the matter, which gave the wife and her legal team a strategic advantage. Early investigative insights helped guide the case from the outset and ensured that the strongest possible evidence was available as proceedings developed.

THE OUTCOME

Our findings provided the family law firm with clear, verifiable evidence that:

The husband’s financial disclosure was incomplete and, in part, falsified, leading to a more equitable settlement for the wife.

Allegations that the wife was an alcoholic and that she operated an OnlyFans account were unfounded and disproved, protecting her reputation and parenting capacity.

Surveillance highlighted inconsistencies in the husband’s reliability, supporting the wife’s claims about his lack of dependability in caring for the children.

By securing her digital accounts, the wife regained privacy and control, preventing further intrusions and strengthening her position in the proceedings.

The result was a favourable outcome for the wife - both financially and in securing stable parenting arrangements for the children.

Crucially, the cost of the investigation was far outweighed by the property settlement achieved. Without our involvement, such an outcome would not have been possible.

LESSONS FOR FAMILY LAW MATTERS

This case highlights several important lessons:

Metadata doesn’t lie: Forensic analysis can expose falsified or manipulated documents.

Independent evidence cuts through allegations: Damaging claims - from alcoholism to online activity - must be tested and either verified or disproved.

Cybersecurity is critical: Protecting personal accounts ensures privacy and prevents misuse of sensitive information.

Surveillance and verification matter: Discreet enquiries can highlight inconsistencies in the opposing party’s conduct.

Early engagement is key: Instructing professional investigators at the start of proceedings ensures evidence is captured when it matters most.

Financial scrutiny ensures fairness: Hidden or misrepresented assets can be uncovered, leading to fairer settlements.

OUR ROLE

We recognise that family law matters involve more than just numbers - they impact lives, reputations, and the wellbeing of children. Our work provides law firms with reliable, court-ready evidence that can withstand scrutiny and help secure fair outcomes for their clients.

When allegations are damaging, when records are falsified, and when digital privacy is compromised, the truth matters more than ever. And at QNA, we deliver it.

NEED CLARITY IN A COMPLEX MATTER

At QNA Investigations, we deliver facts, not assumptions - helping a wide range of clients uncover the truth with precision and integrity. If you’d like to know more, contact us by phone on +61 2 9212 5000 or via email at mail@qnainvestigations.com.au.

CLARITY FIRST: WHY CLIENT INSTRUCTIONS AND INTERVIEWS ARE THE CORNERSTONE OF EVERY INVESTIGATION

HOW THOROUGH INSTRUCTIONS, WELL-CONDUCTED INTERVIEWS, AND CRITICAL ANALYSIS LEAD TO BETTER OUTCOMES

Investigations are built on facts, not assumptions. But before evidence can be gathered - whether through surveillance, interviews, or financial tracing - one essential step comes first: obtaining clear, detailed instructions from the client.

At QNA Investigations, we know from experience that the quality of our outcomes depends directly on the clarity of the starting point. Equally, subsequent interviews with key individuals are the central pillar of any investigation. Together, these elements create the framework for uncovering the truth.

THE POWER OF CLEAR INSTRUCTIONS

When a client first engages us, their instructions form the blueprint for the investigation. Incomplete or vague instructions risk wasted time, higher costs, and inconclusive findings. Clear instructions, by contrast, provide:

Defined objectives: Understanding exactly what the client needs to know - whether it’s verifying assets, assessing credibility, or gathering evidence of misconduct.

Scope control: Setting boundaries ensures the investigation remains focused, targeted, and cost-effective.

Efficiency: With clarity on the issues at hand, investigators can deploy the right resources from the outset.

Transparency: Well-documented instructions protect both the investigator and the client, ensuring that expectations are aligned and outcomes measurable.

In many ways, obtaining instructions from a client is like conducting an interview. The investigator must ask the right questions, clarify ambiguities, and read between the lines to identify what is said - and what is not said. This structured approach ensures the client’s concerns are properly understood and prioritised.

For law firms, having an investigator involved when instructions are first taken can be highly valuable. Investigators bring a different perspective, helping to identify gaps, inconsistencies, or potential leads that may otherwise be overlooked. This collaboration strengthens case strategy from the very beginning.

WHY INTERVIEWS ARE CENTRAL

After clear instructions are secured, interviews become the primary tool for shaping the direction of the investigation. No amount of data or surveillance can substitute for the insights gained from speaking directly with individuals connected to the matter.

Effective interviews provide:

Context: Background that helps investigators interpret documents, digital evidence, or surveillance results.

Leads: New avenues of enquiry that might not otherwise be apparent from the paperwork.

Credibility testing: Discrepancies in statements often reveal more than what is said outright.

Human dimension: Interviews bring the investigation to life, offering insight into motives, pressures, and behaviours.

The investigator’s ability to conduct thorough, well-structured interviews is critical. It requires preparation, active listening, and an understanding of when to probe further. Poorly conducted interviews can leave crucial details unexplored, while effective interviews often uncover information that reshapes the entire trajectory of a case.

THE ROLE OF CRITICAL ANALYSIS

Instructions and interviews provide the raw material of an investigation - but it is critical analysis that turns those inputs into meaningful outcomes. At QNA, we carefully evaluate:

The consistency of statements across interviews and documents.

The plausibility of explanations against established facts.

The relevance of each piece of information to the client’s objectives.

This analytical process ensures that conclusions are evidence-based, defensible, and useful to decision-makers.

THE QNA APPROACH

At QNA Investigations, we place equal weight on the front-end clarity of instructions, the discipline of structured interviews, and the rigour of critical analysis. Our process ensures that:

Every client instruction is confirmed in writing before an investigation begins.

Objectives are clearly defined, so that no time or resources are wasted.

Interviews are carefully prepared and thoroughly conducted, designed to elicit reliable and relevant information.

Findings are critically analysed and cross-checked between instructions, interview accounts, and other evidence sources to ensure accuracy.

Law firms benefit directly when investigators are engaged early - ensuring instructions are clear, gaps are addressed, and strategic evidence-gathering begins without delay.

WHY THIS MATTERS

Investigations without clear instructions risk becoming unfocused fishing expeditions. Investigations without interviews risk being superficial and one-dimensional. And investigations without critical analysis risk being misleading or inconclusive.

Together, clear instructions, thorough interviews, and analytical rigour provide:

A structured foundation that keeps investigations on track.

Credible, defensible findings that stand up in court, tribunals, or negotiations.

Value for clients and law firms, by delivering accurate results in a cost-effective and timely manner.

3 KEY TAKEAWAYS

Clear instructions are everything - they shape the scope, efficiency, and success of any investigation.

Interviews make the difference - a skilled investigator knows how to probe, listen, and uncover insights that documents alone can’t provide.

Critical analysis ties it together - evaluating instructions, interviews, and evidence ensures reliable, defensible outcomes.

CONCLUSION

Whether it’s a complex corporate fraud enquiry, a sensitive family law matter, or an insurance investigation, the principle remains the same: clarity at the start, focus throughout, and critical thinking at every stage.

We believe that obtaining clear instructions, conducting thorough interviews, and applying robust analysis are not just procedural steps - they are the foundation of uncovering the truth.

NEED CLARITY IN A COMPLEX MATTER

At QNA Investigations, we deliver facts, not assumptions - helping a wide range of clients uncover the truth with precision and integrity. If you’d like to know more, contact us by phone on +61 2 9212 5000 or via email at mail@qnainvestigations.com.au.

WAREHOUSE LOSS EXPOSED: HOW A $3.2M CLAIM COLLAPSED UNDER SCRUTINY

A missing shipment, contradictory accounts, and security failures - why this high-value insurance claim never stacked up.

QNA Investigations was engaged by the insurer’s legal representatives to conduct enquiries into a claim involving the alleged theft of custom-made construction materials from a Sydney warehouse. The claim valued the missing goods at more than $3.2 million.

Our investigation revealed not only the difficulty of verifying the loss, but also the risks that arise when contracts, security measures, and record-keeping fall short. Ultimately, the evidence gathered enabled the insurer to deny the claim, preventing a substantial payout on the basis that the loss could not be substantiated.

THE CLAIM

The insured: A logistics and warehousing company operating a large distribution facility.

The client property: Bespoke aluminium façade components belonging to one of the insured’s customers.

The loss: Reported theft of the goods, allegedly worth $3.2 million, during a broad period of time.

The issue: No consistent records or clear evidence that the materials ever existed, were delivered, or were stored securely at the warehouse.

OUR INVESTIGATION

Acting on behalf of the insurer’s lawyers, we carried out comprehensive enquiries, including:

Reviewing police reports, insurance documents, and correspondence.

Conducting on-site inspections of the warehouse.

Interviewing directors, managers, warehouse staff, truck drivers and forklift drivers.

Analysing financial records, invoices, and metadata attached to documents provided after the claim.

Despite extensive efforts, the investigation was hampered by:

Contradictory statements from employees about the existence, storage, and last known sighting of the goods.

A lack of contracts between the warehousing company and its client regarding storage of the materials.

Security failures, including non-functioning CCTV cameras and a site left open and accessible at all times.

Documentation gaps, with records either missing, inconsistent, or created well after the alleged loss.

KEY FINDINGS

Unclear existence of goods: Employees could not consistently describe the number, weight, dimensions, or even the colour of the missing items. Some conceded they may never have seen the goods at all.

Timeline confusion: The reported “loss window” varied dramatically - from two weeks to nearly five months.

Questionable documentation: Invoices provided to substantiate the claim were created after the alleged loss, with figures revised upwards multiple times. Supporting documents lacked explanatory notes and, in some cases, metadata had been removed.

Security failures: The warehouse lacked functioning security measures. Cameras were fake, broken, or livestream only; external gates were never locked.

Potential alternative explanations: Some employees suggested the goods could have been misplaced, delivered to the wrong site, or mis-loaded - rather than stolen.

OUTCOME

Because of the contradictions, poor security, and lack of evidence, the insurer had clear grounds to deny the $3.2 million claim. Without verifiable proof of the goods’ existence or loss, the matter could not meet the evidentiary standard required to justify such a significant payout.

This outcome demonstrates how detailed, independent investigations can provide insurers and their legal teams with the confidence to challenge unsubstantiated claims - and safeguard against multimillion-dollar losses.

LESSONS FOR BUSINESSES

This case illustrates several important lessons:

Contracts matter: Formal agreements between parties protect against uncertainty when losses occur.

Record-keeping is critical: Delivery receipts, photographs, and chain-of-custody documentation are indispensable when high-value goods are at stake.

Security cannot be an afterthought: Warehouses storing client property must have effective, verifiable security measures in place.

Consistency builds credibility: Contradictory accounts and delayed documentation undermine claims and can raise suspicions of fraud.

OUR ROLE

At QNA Investigations, our role is not to assume but to test the evidence. In this case, the absence of consistent records, conflicting testimony, and inadequate security measures meant the insurer’s lawyers could advise their client with confidence: the claim did not hold.

For insurers, law firms, and businesses, the lesson is clear: when multimillion-dollar sums are at stake, robust processes are your best protection - and when things go wrong, experienced investigators are essential.

NEED CLARITY IN A COMPLEX MATTER

At QNA Investigations, we deliver facts, not assumptions - helping a wide range of clients uncover the truth with precision and integrity. If you’d like to know more, contact us by phone on +61 2 9212 5000 or via email at mail@qnainvestigations.com.au.

THE END OF ANONYMITY? WHAT AUSTRALIA’S NEW SOCIAL MEDIA RULES MEAN FOR PRIVACY AND INVESTIGATIONS

Australia is preparing to introduce some of the world’s strictest rules for social media platforms on 10 December 2025. While no formal assessments have been made, the age restrictions are likely to apply to Facebook, Instagram, SnapChat, TikTok, X (formally Twitter) and YouTube. Each platform will be legally required to take “reasonable steps” to prevent Australians under the age of 16 from opening or maintaining accounts.

The stated aim is child protection. But these reforms mark a significant turning point in online privacy. By forcing platforms to verify age more reliably than ever before, the new regime signals the slow erosion of anonymity and pseudonymity on the internet.

WHAT’S CHANGING?

Under the new framework:

Social media platforms must take reasonable steps to prevent under-16s from holding accounts - including deactivating existing under-age accounts. Penalties for non-compliance are severe - fines of up to $49.5 million AUD.

Age cannot be verified solely by a self-declared birthdate. Platforms will need to adopt age assurance methods that are more robust, potentially including ID checks, facial age estimation, or AI-driven behavioural analysis.

Government ID may be requested, but cannot be the only option - less intrusive alternatives must be offered.

Platforms in scope include major social media providers - some services such as certain messaging and gaming platforms are excluded.

Importantly, children and their families are not penalised under the law - the obligations rest squarely with platforms.

HOW ANONYMITY IS BEING ERODED

Historically, creating a social media profile required little more than an email address and a made-up birthday. The new laws disrupt that model:

Verification equals exposure: To meet regulatory obligations, platforms must collect stronger evidence of a user’s age - which risks linking previously anonymous accounts to real identities.

Pseudonyms under pressure: Those who rely on pseudonyms - whistleblowers, victims of abuse, or individuals simply valuing privacy - may find their anonymity weakened if verification processes tie their identity back to their account.

Data collection risks: Whether via government ID uploads, facial scans, or behavioural profiling, sensitive personal information will be gathered at greater scale. That means higher stakes if data is hacked, leaked, or misused.

Unseen profiling: Some age-assurance systems infer age through AI or behavioural signals. Users may not even know what data is being harvested or how it is being judged.

WHY THIS MATTERS FOR INVESTIGATIONS

For investigators, these reforms bring both opportunities and challenges:

Opportunities: Tighter age verification could make it easier to trace fraudulent accounts, confirm identities, and build clearer evidentiary links between online activity and real people.

Challenges: Reliance on algorithmic systems brings the risk of bias, inaccuracies, and false positives. Misclassifications could complicate evidence gathering, digital forensics, and legal proceedings.

At QNA Investigations, we are already considering how these regulatory changes will reshape the online environment. As anonymity declines, new forms of deception, circumvention, and identity manipulation will emerge. Navigating this landscape will require not only technical expertise but also a clear understanding of how “reasonable steps” are interpreted in practice.

KEY TAKEAWAYS

Effective date: From 10 December 2025, major platforms face strict obligations to prevent under-16s from holding accounts.

Penalties: Fines of up to $49.5m apply to platforms that fail to take “reasonable steps”.

Privacy impact: The reforms accelerate the erosion of anonymity and pseudonymity online.

Balance: While the rules aim to protect children, they also reshape how identity, privacy, and accountability work in the digital world.

HOW QNA CAN HELP

QNA Investigations assists law firms, insurers, and corporations in:

Managing risks around privacy, identity exposure, and online fraud.

Tracing and verifying digital identities in an environment of increasing regulation.

Delivering accurate, actionable intelligence for legal, corporate, and insurance matters.

As online anonymity continues to shrink, one principle remains constant: Questions Need Answers. At QNA Investigations, we deliver them.

Read the eSafety Commissioner’s latest publication here.

NEED CLARITY IN A COMPLEX MATTER

At QNA Investigations, we deliver facts, not assumptions - helping a wide range of clients uncover the truth with precision and integrity. If you’d like to know more, contact us by phone on +61 2 9212 5000 or via email at mail@qnainvestigations.com.au.

FROM LUXURY TO EXTORTION: HOW A $12OK WATCH COST A CEO $19M

It began with a luxury watch.

Our client, the CEO of a national construction company, purchased an authentic timepiece for $120,000 from a gray-market dealer. What should have been a one-off indulgence quickly spiralled into something far darker.

The dealer wasn’t just a salesman - he became a friend. Dinners, family introductions, even shared holidays. For a man who admitted his life was otherwise “sheltered” and “mundane”, the relationship was intoxicating. This new friend promised excitement, adventure, and access to a lifestyle he’d never known.

But behind the charm lay something sinister.

A FRIENDSHIP TURNS TO FEAR

The dealer confided in our client: his life was in danger. Outlaw motorcycle gang members were plotting against him, and the dealer claimed he had already been paying them for the CEO’s “protection”.

The message was chilling: your life is in my hands.

Soon, the demands for money began.

At first, our client believed he had paid $2.4 million over 12 months. But when he turned to QNA Investigations, we uncovered the devastating truth: $12.1 million had been siphoned in the first year alone - with another $6.7 million in the months that followed.

THE INVESTIGATION

Our team worked relentlessly - uncovering the dealer’s true identity, dissecting thousands of bank transfers and emails, and mapping the flow of millions.

Piece by piece, the deception unravelled. What started as a luxury watch had become a multimillion-dollar extortion scheme - one that threatened not only our client’s finances, but also his freedom and reputation.

THE TURNING POINT

Armed with evidence, we liaised with NSW Police, secured legal representation for our client, and prepared a comprehensive brief of evidence that exposed the full scale of the fraud.

The result? The extortion ended. The dealer’s manipulation collapsed. And following further police investigation, the man behind it all was arrested.

THE LESSON

This case shows how quickly trust can be weaponised. A single purchase - a moment of indulgence - triggered a chain of events that cost millions and nearly destroyed a career.

We uncover the truth when deception runs deep. And when the stakes are this high, the truth is the only thing that can set you free.

NEED CLARITY IN A COMPLEX MATTER

At QNA Investigations, we deliver facts, not assumptions - helping a wide range of clients uncover the truth with precision and integrity. If you’d like to know more, contact us by phone on +61 2 9212 5000 or via email at mail@qnainvestigations.com.au.

WHEN TRUST IS BETRAYED: LESSONS FROM A CASE OF DECEPTION, FETISHISM, AND FRAUD

The medical profession demands trust, compassion, and integrity - values shattered by the recent case of 49-year-old UK vascular surgeon Neil Hopper. In an astonishing act that blends deception, fetishism, and fraud, Hopper deliberately harmed himself to become an amputee, then fabricated a medical story to profit from the ensuing sympathy.

A SELF-INFLICTED BETRAYAL

In a chilling twist of body dysmorphia and deviant desire, Hopper used dry ice to freeze his legs for eight hours until amputation became mandatory. He then falsely claimed that the amputations were due to sepsis stemming from a family camping trip, winning public sympathy and even appearing on Good Morning Britain.

A WEB OF FRAUD, FANTASY, AND FINANCIAL GAIN

Hopper submitted deceitful insurance claims totalling around £466,000 (AUS $960,000), proceeds he lavished on luxury spending, including a campervan, a jacuzzi, home renovations, and more.

His motive wasn’t purely financial. Court evidence revealed a deep-seated sexual fixation on amputation - a chilling combination of obsession and opportunity. Hopper purchased extreme pornography from the notorious EunuchMaker website and exchanged thousands of messages with its operator, Marius Gustavson (a convicted criminal), where he discussed how to induce the desired self-harm.

THE FALL AND ITS BROADER IMPLICATIONS

In Truro Crown Court, Hopper admitted to two counts of fraud by false representation and three counts of possessing extreme pornographic material. He received a 32-month prison sentence, comprising 22 months for fraud and 10 months for pornography-related offences. He was also served with a 10-year Sexual Harm Prevention Order, and legal proceedings are underway to recover his ill-gotten gains.

Hopper’s past patients, understandably disturbed, worry this betrayal may extend further - some question whether their amputations were medically necessary. Although hospital review boards found no evidence that patient care was compromised, calls for independent investigations grow louder.

LESSONS FOR INVESTIGATIONS & ETHICS

This tragic saga highlights several critical issues:

Trust and Professional Integrity - When the public’s trust in professionals is exploited, the damage extends far beyond the individual - it undermines entire systems meant to protect and heal.

Complexity of Motivations - Legal cases must navigate the messy intersection of self-harm, sexuality, mental health, and deception. Understanding these layers is essential for just outcomes.

Cultural Oversight & Preventive Safeguards - Monitoring extreme subcultures - such as the EunuchMaker network - is challenging yet vital. Law enforcement and healthcare institutions must be vigilant to unearth such harmful networks.

Supporting Victims Beyond the Visible Harm - Patients and families affected by Hopper’s deception deserve transparent communication and ongoing support, whether through clinical reviews or legal avenues.

FINAL THOUGHTS: WHEN INVESTIGATION MEETS ETHICS

The story of Neil Hopper is deeply unsettling - an eerie blend of self-inflicted injury, financial fraud, and fetishism. It’s a stark reminder that even the most trusted professionals can conceal dangerous obsessions. The broader lesson is clear: investigative integrity, multidisciplinary collaboration (law, psychology, healthcare), and ethical vigilance are essential to prevent and respond to such breaches of trust.

Read the original article here

NEED CLARITY IN A COMPLEX MATTER?

At QNA Investigations, we deliver facts, not assumptions - helping a wide range of clients uncover the truth with precision and integrity. If you’d like to know more, contact us by phone on +61 2 9212 5000 or via email at mail@qnainvestigations.com.au.

WHAT DOES QNA STAND FOR?

At QNA Investigations, our name represents more than just three letters - it reflects the philosophy behind everything we do. Over time, QNA has taken on several powerful meanings, each capturing a different aspect of our investigative approach.

QUESTIONS NEED ANSWERS → Every investigation begins with questions. Our role is to follow the evidence and uncover the truth - because unanswered questions only create uncertainty.

QUESTIONS NOT ASSUMPTIONS → Assumptions can mislead and distort outcomes. We rely on facts, not speculation, ensuring our clients receive clarity based on verifiable information.

QUESTIONS NAVIGATE ANSWERS → Asking the right questions acts like a compass, guiding us through complex matters toward the answers that matter most.

QUESTIONS NEUTRALIZE ASSUMPTIONS → Assumptions can cloud judgment. By systematically questioning them, we dismantle bias and reveal the real picture - an essential step in sensitive or high-stakes matters.

QUALITY. NEUTRALITY. ACCURACY. → Beyond the questions, our values ensure results you can rely on. Every QNA investigation is conducted with the highest standards of quality, the neutrality clients expect, and the accuracy they depend on.

Whether you see QNA as Questions Need Answers or Quality. Neutrality. Accuracy., the meaning is the same: we exist to uncover the truth and deliver it with clarity, precision, and integrity.

NEED CLARITY IN A COMPLEX MATTER

At QNA Investigations, we deliver facts, not assumptions - helping a wide range of clients uncover the truth with precision and integrity. If you’d like to know more, contact us by phone on +61 2 9212 5000 or via email at mail@qnainvestigations.com.au.

PI-101: WHAT EXACTLY DOES A PROFESSIONAL INVESTIGATOR DO?

PI-101: What exactly does a professional investigator do?

A lot more than you think!

Being an investigator is an exciting career - every week brings confidential, complex, and fascinating matters from clients across industries.

Unfortunately, thanks to movies and TV, many people think investigators spend their time in trench coats, hiding behind bushes with a long-lens camera. Others picture Tom Selleck in Magnum P.I. The reality? Very different.

That’s why many of us prefer the term professional investigator. It better reflects who we are: experienced, discreet, and operating strictly within the law.

So, what do we actually do?

Professional investigators assist individuals, businesses, law firms, insurers, financial institutions, and government agencies in countless ways, including:

Asset location investigations - hidden assets and investments

Background checks - for business or personal relationships

Business & corporate crime investigations - fraud, corruption, insider trading, sabotage

Cybercrime - misuse of information, IP theft, unauthorised access

Identity theft - fraudulent applications, bank withdrawals, false identities

Independent audits - verifying or reviewing reports